Sustainable investing with ETFs

With True Wealth, you can invest in companies that are among the best in their class. Benefit from our cost-efficient sustainable investment solution.

Your investment with ESG criteria

Sustainable investing combines returns with personal values and principles.

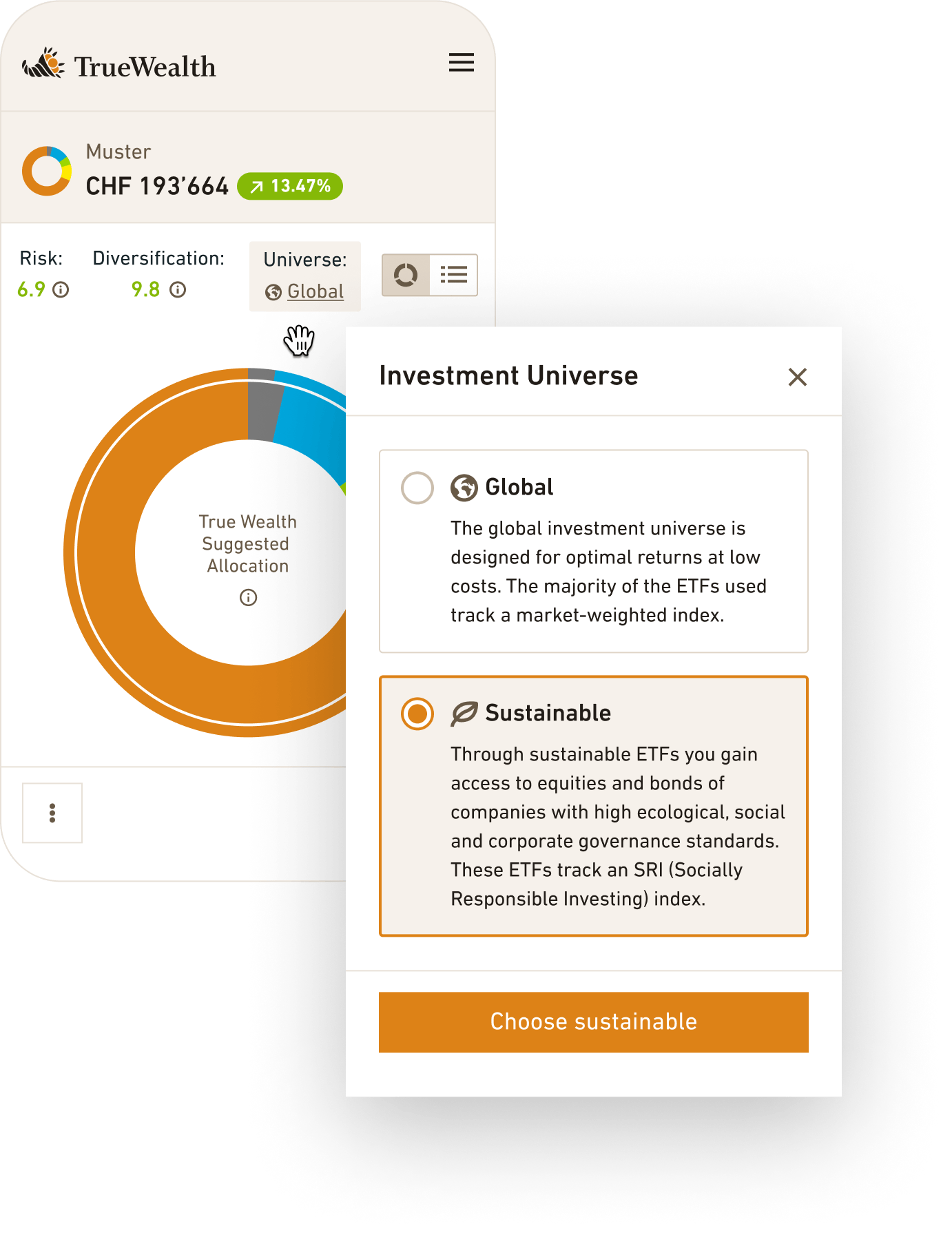

Whether you opt for our asset management solution, the 3rd pillar or an ETF portfolio for your child: We offer you the choice between the global and the sustainable investment universe.

Our promise: We select the most cost-efficient, liquid and suitable ETFs for you.

When you invest sustainably with us, we construct your equity portfolio preferably from ETFs on sustainable indices such as the MSCI SRI indices. SRI only includes the top 25% of companies in an industry with the highest ESG rating.

Companies that generate a significant proportion of their turnover in the following harmful areas are generally excluded prior to this screening:

- Weapons

- Alcohol, tobacco

- Gambling

- Nuclear power

- Adult entertainment

- Mining of thermal coal

According to MSCI, indices with the suffix SRI focus on companies with particularly high ESG ratings.

What are the three pillars of ESG?

Environment

- Environmental protection

- Climate change

- Scarcity of resources

- Biodiversity

Social Responsibility

- Occupational safety

- Health protection

- Employee rights

- Compliance with ESG standards by suppliers

Governance

- Corporate governance

- Risk management

- Accountability

- Ethical business practices

A comparison of returns and costs

Sustainable ETFs aim to achieve returns comparable to their conventional counterparts over the long term. We do not use single stock picking, as this is tantamount to active management and incurs high costs. In our sustainable portfolios, we use market capitalization-weighted ETFs that track strict SRI indices. Let's take a look at the past returns of these indices:

January 2020 to December 2024: Sustainable SRI indices in various markets either underperformed or performed in line with their conventional counterparts.

Due to the additional criteria according to which the companies must be assessed, sustainable investment instruments are somewhat more expensive than their conventional counterparts. On average, the external product costs are around 0.08 percent higher and amount to 0.21 percent.

However, our asset management fee for sustainable portfolios remains unchanged: 0.25 to 0.50 percent per year, depending on the amount invested. We report all costs transparently. Click here for the cost overview.

Impact on society and the environment

Sustainable investing should not be seen as a substitute for sustainable action and political decisions. ESG investments can certainly make sense if they make your investments more compatible with your ethical principles. However, you should not assume an impact beyond this or an excess return with a liquid portfolio based on sustainability criteria (more on this in the blog Greenwashing: The limits of ESG and impact investing).

How do I choose a sustainable investment strategy?

You can easily select a sustainable investment strategy in our app or in the desktop version of our investment solution. There are two investment universes to choose from: the global universe and the sustainable universe.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account