#31 Are dividend shares worth it?

Those who have capital and want to generate a return from it, e.g. after retirement, have three options: investing in fixed-interest securities, investing in dividend-paying stocks, or investing in a market breadth and regularly paying out partial amounts.

Dividend stocks are shares in companies that regularly distribute a portion of their profits to their shareholders. These are often established, profitable companies with a long track record of success. These stocks offer investors the opportunity to earn a passive income without having to sell their shares.

A dividend exchange-traded fund (ETF), on the other hand, is a fund that bundles a wide selection of such dividend stocks into a single financial product. One example is the MSCI World High Dividend Yield Index, which tracks high-yielding companies from the global stock market.

The appeal of dividend ETFs

Dividend ETFs are particularly appealing to many investors because they promise regular distributions and offer a degree of stability, as the companies they contain are usually established market participants with stable cash flows. These characteristics are particularly interesting for investors looking for a continuous stream of income – for example, in retirement or when they want to cover their current expenses from their investments.

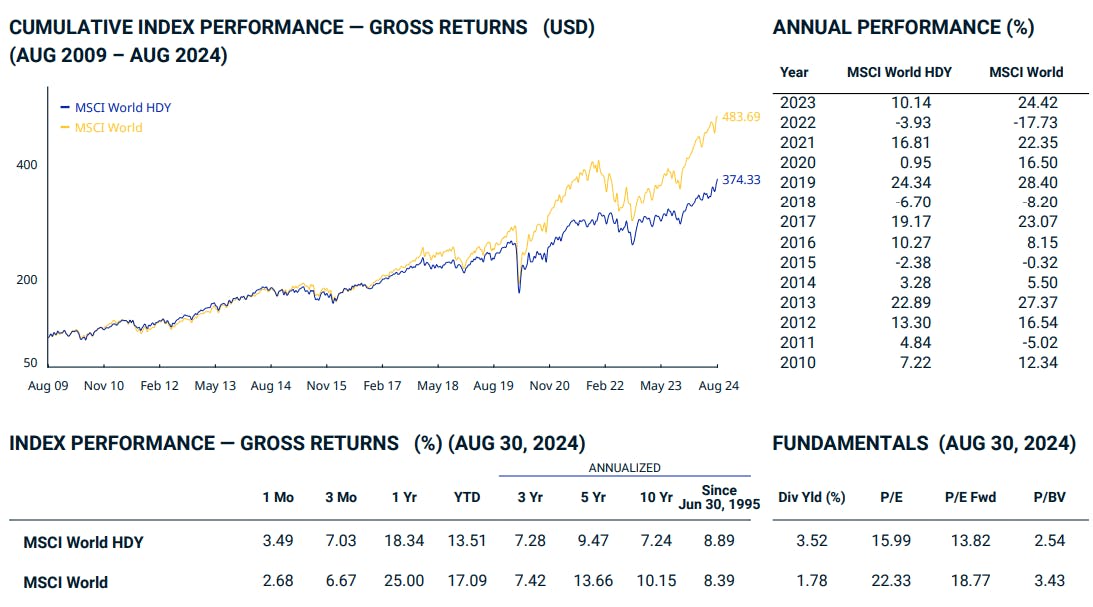

But are dividend ETFs worth investing in? To answer this question, let's take a look at the past performance of two ETFs. Let's compare the aforementioned MSCI World High Dividend Yield Index with the MSCI World Index.

Performance comparison: dividend stocks versus broad market index

Based on historical data, we see that the MSCI World Index has generated an annualized return of around 10% over the last ten years. By comparison, the MSCI World High Dividend Yield Index, which focuses on high-yielding companies, was around 7%. This means that the dividend ETF generated an average of 3% less return – year after year.

A look at shorter periods of one, three or five years shows similar results: here, too, the dividend ETF performed worse than the broad-based index. The reason for this is obvious: although dividend stocks regularly distribute profits to shareholders, they also have less capital available to invest in their own business or to buy back shares, which often leads to price increases.

It is also important to mention that high-dividend stocks are also included in the broad MSCI World Index. The main difference is that they do not receive any special favoring in the standard index. Thus, the MSCI World had a dividend yield of 1.8%, and the high-dividend index had double that, around 3.6%.

Compared to the MSCI World Index, the High Dividend Yield Index had lower volatility, which can be seen as an advantage in times of economic uncertainty. However, it should be kept in mind that risk and opportunity are always linked when investing. With a dividend ETF, you take less risk, but you also give up the full return potential of a broad-based portfolio.

Taxation of dividends

Another important aspect that investors should not ignore is the tax treatment of dividends. In Switzerland, capital gains are generally tax-free for private investors. This makes stocks that increase in value through price gains particularly attractive. However, the state levies a withholding tax of 35% on dividends, which can be reclaimed if declared correctly, meaning that dividend income is ultimately taxed at the income tax rate. This also delays the compound interest effect, as the reclaimed money cannot be reinvested in the meantime.

It is precisely this tax burden that makes dividend stocks less attractive for Swiss private investors. Here, a market-wide portfolio without a focus on dividends offers certain advantages, as it benefits from capital gains that are not subject to withholding tax.

So are dividend stocks worthwhile?

What counts in the end is the total return. That is, the sum of the dividend yield and capital gains, to decide what is worthwhile for you. However, Switzerland is one of the few countries that does not levy a capital gains tax. Therefore, the market-wide approach is often advantageous for Swiss investors from a tax perspective.

As always, your investment decisions should be based on your individual goals, risk tolerance and investment horizon.

What do you think about dividend stocks? Have you already had experiences with dividend ETFs? Please feel free to leave me your feedback via email.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account