About Felix Niederer

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Articles by Felix Niederer

Pension fund withdrawal: How to do it

BVG series part III Contributions from employees, employers, and long-term...

Comparison of interest rates for pillar 3a apps

Pillar 3a is ideal for long-term wealth accumulation through investments. It is...

#54 Survivorship bias: Only the surviving funds make history

The so-called survivorship bias – the tendency to favor survivors – is a common...

Occupational pension plan throughout life

BVG series part II What needs to be considered in different life situations,...

Introduction to occupational pension plans (BVG)

BVG series part I Almost all employees and some self-employed persons are...

Talk – How do young people invest?

Henry and Mattia became interested in investing at an early age and began...

#53 Stocks are also worthwhile for retirees

When you reach retirement age, statistically speaking, you still have more than...

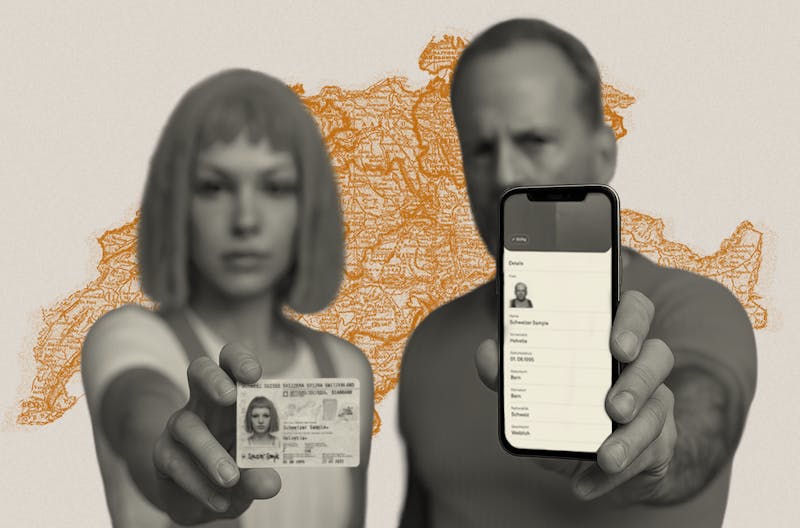

E-ID: What would change for our customers?

Electronic identity is making a new start. After the people rejected the first...

#52 Retroactive 3a payments: What you need to bear in mind

The government has relaxed the rules for Pillar 3a. From 2026, you will also be...

Pillar 3a: Those who don't switch are giving away a fortune

A switch to more securities and lower fees: changing your Pillar 3a takes just...

#51 What are options and how do they work?

Options allow you to bet on rising or falling prices. In the latter case, the...

A successful start on the stock market – made easy with ETFs

In the current environment of low interest rates and expensive real estate, the...

#50 ETF savings plan or digital wealth manager: which one is better?

ETF savings plans are becoming increasingly popular. But what exactly is an ETF...

The crux of withholding tax

In Switzerland, the withholding tax can be reclaimed relatively easily....

#49 How do I read my pension fund statement correctly?

Every year, you receive a personal pension statement from your pension fund....

Greater transparency in terms of performance

As an investor you should pay attention to how funds and wealth managers handle...

Four rules for investors under forty

There's a lot you can learn from old masters like Warren Buffett and Burton...

#48 Performance Fee: Friend or Foe?

Imagine you place a bet on rising stock prices. If you win, the profits are...

#47 Actively managed ETFs: what you need to know

Actively managed ETFs are currently experiencing a real boom in the US. They...

What to Look for When Choosing ETFs

You can easily manage an ETF portfolio yourself. However, a digital wealth...

#46 Active vs. passive funds: Which one performs better?

More and more investors are opting for a passive investment strategy. But what...

Everything you need to know about Pillar 3a withdrawals

Saving for private retirement significantly increases your retirement assets...

#45 The 3-pillar system simply explained

Pension provision in Switzerland is based on a three-pillar system that was...

Pillar 3a: How to save twice as much tax

With the third pillar, you can save on taxes, not just when you make a deposit....

#44 How do I withdraw my assets properly?

At some point in life, the moment comes when you decide to work less or not at...

MSCI World: What the global ETF can't do

The MSCI World stock index and its more broadly diversified sibling, the All...

#43 Cost averaging: Smart strategy or expensive myth?

Regular investments ensure a lower average price – or so the promise goes. A...

The basics of investing

Everyone handles money differently. Some are conscientious savers, others spend...

Talk – Start-up country Switzerland with Olivier Kofler

Olivier Kofler is an experienced entrepreneur and CEO of Carvolution, a...

#42 Leveraged ETFs promise dream returns. Is there a catch?

Leveraged ETFs are special investment instruments that use derivatives to...

Why Trump only talks about the trade deficit

Trump is imposing steep tariffs on goods imports and excluding services....

Drawdown: How much loss can you afford?

Stocks yield better returns than other investments. But corrections are part of...

#41 Full transparency of individual securities: with the ETF-Lookthrough

ETFs are efficient and popular investment instruments, but many investors find...

Talk – Start-up country Switzerland with Andri Silberschmidt

Welcome to another episode in our podcast series on the topic of «Start-up...

#40 Apparent security: the hidden costs of 3a savings policies

Pillar 3a is an important instrument for retirement planning in Switzerland. It...

Talk – How parents invest and save for their children

The question of how parents secure the financial future of their children is...

#39 How is money created?

Money creation refers to the process by which new money is brought into...

#38 Exchange fees: the hidden yield eater

Many of us are familiar with exchange fees from our vacations. However, they...

Tax Return: Completed Faster, More Money Back

By the end of March: Extend the deadline or submit your tax return. We will...

#37 Investing with Low Risk: Am I Limited to Swiss Investments?

Many investors with low risk tolerance wonder whether they are limited to...

#36 The biggest pitfalls when investing

Do investors invest according to purely rational criteria such as investment...

#35 Voluntarily paying into the 2nd pillar: is it worth it?

In Switzerland, employees pay contributions to their pension fund together with...

#34 Do multiple investment strategies make sense?

Many investors spread their assets across several portfolios that pursue...

#33 Withholding tax-exempt index funds in the 3rd Pillar

Although we at True Wealth do not charge a management fee in the 3rd Pillar,...

#32 Distributing or accumulating ETF: which is better?

ETFs offer a simple way to invest in broad markets or specific sectors without...

#31 Are dividend shares worth it?

Those who have capital and want to generate a return from it, e.g. after...

Talk – What is the state of financial literacy among the Swiss population?

What are the Swiss population's financial skills like? We wanted to find out...

Talk – Start-up country Switzerland with Nicola Forster

Switzerland is an innovative country with world-leading science centers that...

#30 How to read a factsheet?

Before you invest in an ETF (Exchange Traded Fund), you should not only take a...

#29 Home bias: Why domestic investment products are not always the best choice

Many investors tend to invest in what they know well and are familiar with –...

#28 Payment for order flow: a controversial practice in equity trading

How do free brokers earn money with your trades? The trick is called payment...

#27 The 5 best-known investment styles for equity portfolios

To date, various investment styles have become established, which investors use...

Talk – Start-up country Switzerland with Dr. Thomas Dübendorfer

Welcome to the first episode in a series of podcasts on the topic of...

#26 Improve your long-term returns with currency hedging

Currency hedging can help you improve your returns over the long term. Find out...

#25 Cash is the most expensive asset class

Cash doesn't belong under your mattress or in your portfolio. Find out why in...

#24 Investing in commodities: an introduction

What are the advantages and disadvantages of investing in commodities, and how...

These fees apply when investing in Switzerland

Most investors are now aware that high fees and costs are real yield eaters....

#23 Real estate or REITs: Which is the better investment?

Buying or renting a property? A question that occupies many people. It is also...

#22 The second most important asset class: bonds

Bonds and equities are often mixed by investment professionals. What exactly...

#21 The most popular asset class: equities

Shares are one of the most popular asset classes. The total value of all listed...

#20 Investment advice and wealth management: what's the difference?

Investors today have several options when it comes to investing their money....

Talk – Capitalism and the Market Economy

What is capitalism? What is wrong with capitalism? And how can we fix it? In...

The 9 most common investment mistakes – and how to avoid them

Investing your money instead of leaving it in your bank account means you can...

#19 How to invest after retirement?

The decision between a lump-sum withdrawal and a pension after retirement is...

#18 Why regular investments pay off

Why regular investing not only makes many things easier, but also often leads...

Who benefits from the 13th AHV pension?

Anyone who has to live on their own in old age from the AHV is financially...

#17 What makes a good wealth manager?

What is important when choosing a wealth manager? Learn more about...

#16 FX Hedging: To hedge currency risk or not?

FX hedging, or hedging against currency risks, is a topic that is often...

ETF savings plan Switzerland: How to do it right

You shouldn't wait to build up your assets and invest the money you have...

The ETF Boom: Growth for All

From an academic mind game to the standard of the modern investor: the triumph...

#15 Why not go all in on the MSCI World?

The MSCI World ETF is one of the most popular ETFs among investors. But is it...

Staggering Investments: Forgoing Returns for a Good Night's Sleep

A conservative strategy that is repeatedly recommended is not to invest a large...

#14 Who benefits from stock picking?

In this podcast, we look at single stock picking: the art of selecting stocks...

#13 Trading or investing: What's the difference?

Trading can be tempting. The thrill of a successful trade releases dopamine....

#12 How does the Black-Litterman model work?

In today's Coffee Break, we take a deep dive into the world of modern portfolio...

Talk – Is there an investment mentality?

Find out from Oliver Herren, co-founder of Digitec Galaxus, how his investment...

Talk – What is the economic situation in Switzerland?

Professor Dr. Tobias Straumann, one of Switzerland's best-known economists and...

#11 What you need to know about benchmarks

Benchmarks are extremely useful for assessing investment instruments and...

Talk – How to teach children about the world of finance

Our guest in today's Coffee Talk is Aysha van de Paer, financial expert and...

#10 Child portfolio: Investing for and with children

Why investing in securities is the best choice and how children's portfolios...

Three times ten percent: how to save for a better future

Wealth makes dreams come true. Or just makes you feel good. But how do you...

Talk – Financial education of the Swiss (youth)

Our guest is Michael Kendzia, economist and head of the BSc International...

Talk – What is money?

In today's Coffee Talk, we talk about a fascinating topic that is commonplace...

#9 Our investment approach

Discover the groundbreaking work of two outstanding academics and how they have...

#8 No time for Pillar 3a?

In this blog post, we take a look at Pillar 3a and whether it's really worth...

#7 Does sustainable investing work?

The world of investing has changed dramatically in recent years as more and...

Greenwashing: The limits of ESG and impact investing

Impact investing promises to make our world a little bit better with...

The cost of market timing: A look at the SMI

At first glance, market timing seems like a tempting strategy. Buy when prices...

#6 Drawdown: How much loss can you afford?

Today we are talking about a topic that is of great importance to many of you:...

Talk – What does the Swiss National Bank do?

In this Coffee Talk, we talk to a very special guest, Dominik Boos, lecturer at...

#5 Is now a good time to invest?

The question you've probably asked yourself many times is, «When is the right...

#4 Why do banking crises keep happening?

Banking crises and their impact on your hard-earned money. In this podcast, we...

#3 How to build a portfolio with ETF?

Welcome back to another exciting edition of our Coffee Break. In the last...

Child portfolio with ETF: A head start for life

Wealth grows best with a long investment horizon. That's why True Wealth offers...

#2 What is an ETF? And what to look for when choosing one?

Have you heard of ETF before but not sure what ETF is exactly? Don't worry,...

Talk - Why did you start True Wealth?

From an unexpected fortune to a digital wealth manager. In today's Coffee Talk,...

#1 What is the benefit of wealth management?

At a time when investing is becoming increasingly important and accessible,...

Five Reasons why we build portfolios from ETFs

Why have we been consistently using ETFs at True Wealth for 10 years? Discover...

Several accounts, one strategy: With a clear focus to investment success.

The optimal portfolio needs investments in multiple asset classes. But only one...

Security: How We Protect Your Assets

With True Wealth, you can rely on innovative asset management by a start-up....

Investing with ETF: Stops are for traders only

ETFs are just as popular with investors as they are with traders. However, both...

Why do banking crises happen every so often?

In recent weeks, many people have been asking themselves: How safe is my money...

No detours to free asset management – it's that easy

You have paid in your annual 3a maximum contribution and want to continue...

Inflation: The Tax Nobody Wants to Pay

Inflation eats away at income and wealth, just like a tax. It's the tax we...

The lowest fees in Switzerland

Low costs, highest transparency and an extremely user-friendly product: True...

Bonds in Inflation: Safe is Suddenly No Longer Safe

Normally, bonds provide security to your portfolio. In periods of inflation,...

Inflation: Protecting Wealth With Real Assets

Commodities, stocks, real estate: Real assets tend to preserve their value...

How Do You Exchange 50 Million in an ETF?

We choose exclusively liquid ETFs with low bid-ask spreads. But how do we...

How much Russia is there in my portfolio?

How large is the share of Russian shares or bonds in my portfolio? And do I...

«Women need to get off the sidelines and start investing now»

We sat down for an exclusive interview with the Swiss «Finfluencer» Aysha van...

True Wealth reduces its fees

True Wealth has crossed the threshold of 5'000 clients and CHF 290 million...

High cash inflows at True Wealth due to low share prices

Many investors see the falling share prices as an opportunity to enter the...

Negative interest rates: These are your two options

Negative interest rates, coupled with high fees and inflation, mean savings are...

True Wealth: On the road to success for five years

Professional asset management for everyone – with this goal, we founded True...

Over 3,000 clients and 200 million assets

True Wealth has developed steadily since its launch in 2014. In the direct...

Finally investing sustainably with ETFs

Thanks to new ETFs, you can invest in a more environmentally friendly and...

Behind the scenes: How the robo-advisor trades for you

Passive investing – it sounds like doing nothing. But in fact, trades are...

Put all your eggs in one basket: Diversification

Without risks, no returns. But if you diversify, you can get the maximum return...

Money-weighted return: How to expose tactical trading

At True Wealth, we measure returns using two methods: money-weighted and...

Hedge funds: suitable for qualified investors?

FINMA protects small investors from hedge funds. Hedge funds are only permitted...

Action Bias: Peace of Mind Pays Off

Too much trading spoils your performance. Here you will learn why you should...

Young investors opt for ETFs

Young investors are increasingly investing in ETFs. But why exactly are they so...

True Wealth and the year 2016

2016 was also an exciting year for us. A brief review on our own behalf.

Trump and the forecasts

The world eagerly awaited the Trump shock, but it never came. The forecasters...

Smart beta: how smart is it really?

At True Wealth, we rely on passive investing, on pure beta, for our clients'...

True Wealth app for your smartphone

As a real Internet company, you also have to be accessible on the move. True...

True Wealth removes the minimum fee

True Wealth, the number one in online wealth management in Switzerland, is...

Invest Regularly – Even After Losses

When investing, the mood swings with portfolio performance. This is very human,...