#42 Leveraged ETFs promise dream returns. Is there a catch?

Leveraged ETFs are special investment instruments that use derivatives to create a leverage effect on a specific index. This means that the performance of the underlying asset, e.g. a stock index, is not only reflected one-to-one, but multiplied. At first glance, these ETFs promise high returns, but they also entail significant risks that investors should be aware of before adding such products to their portfolios.

How do leveraged ETFs work?

A traditional exchange-traded fund (ETF) typically tracks the performance of a particular index by physically holding the underlying stocks or securities. The aim is to replicate the index as closely as possible. A leveraged ETF goes one step further: it uses financial derivatives to multiply the gains or losses of the underlying index – often by two or three times, sometimes even more.

This leverage works both ways. Let's take an ETF with a leverage of two: a one percent daily gain in the underlying asset results in a two percent daily gain for the leveraged ETF. Conversely, a one percent daily loss in the underlying asset results in a two percent daily loss for the leveraged ETF.

Or let's assume an ETF has a leverage of five: if the underlying asset loses 20 percent in one day – admittedly an extreme scenario – then you would suffer a total loss with the leveraged ETF in a single day.

So these are high-risk products. But that's only one problem.

The risks of a leveraged ETF

A more subtle risk, but one that is all the more important in the long term, is what is known as path dependency. This means that short-term volatility can have a negative impact in the long term. With a normal ETF, it doesn't matter how much the markets fluctuate within a year – what matters is the end result. With a leveraged ETF, on the other hand, volatility has a direct impact on performance.

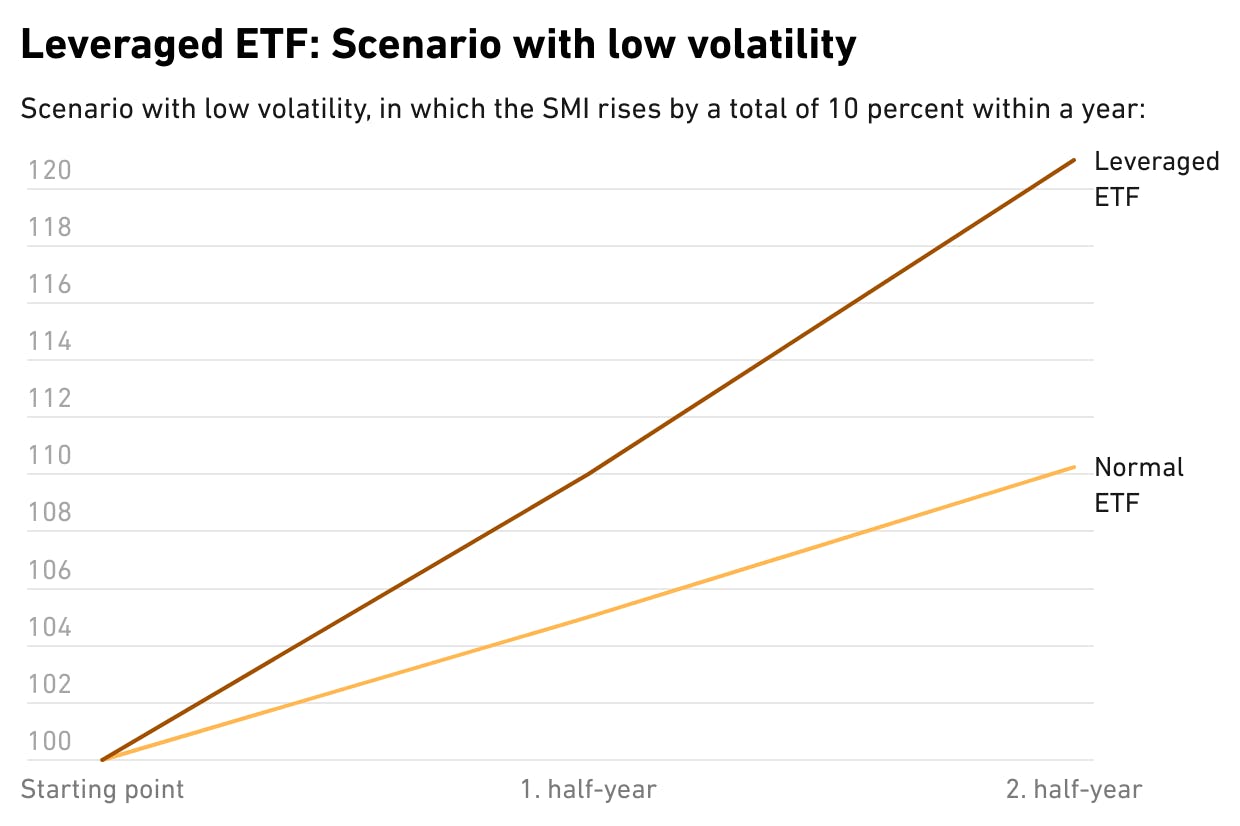

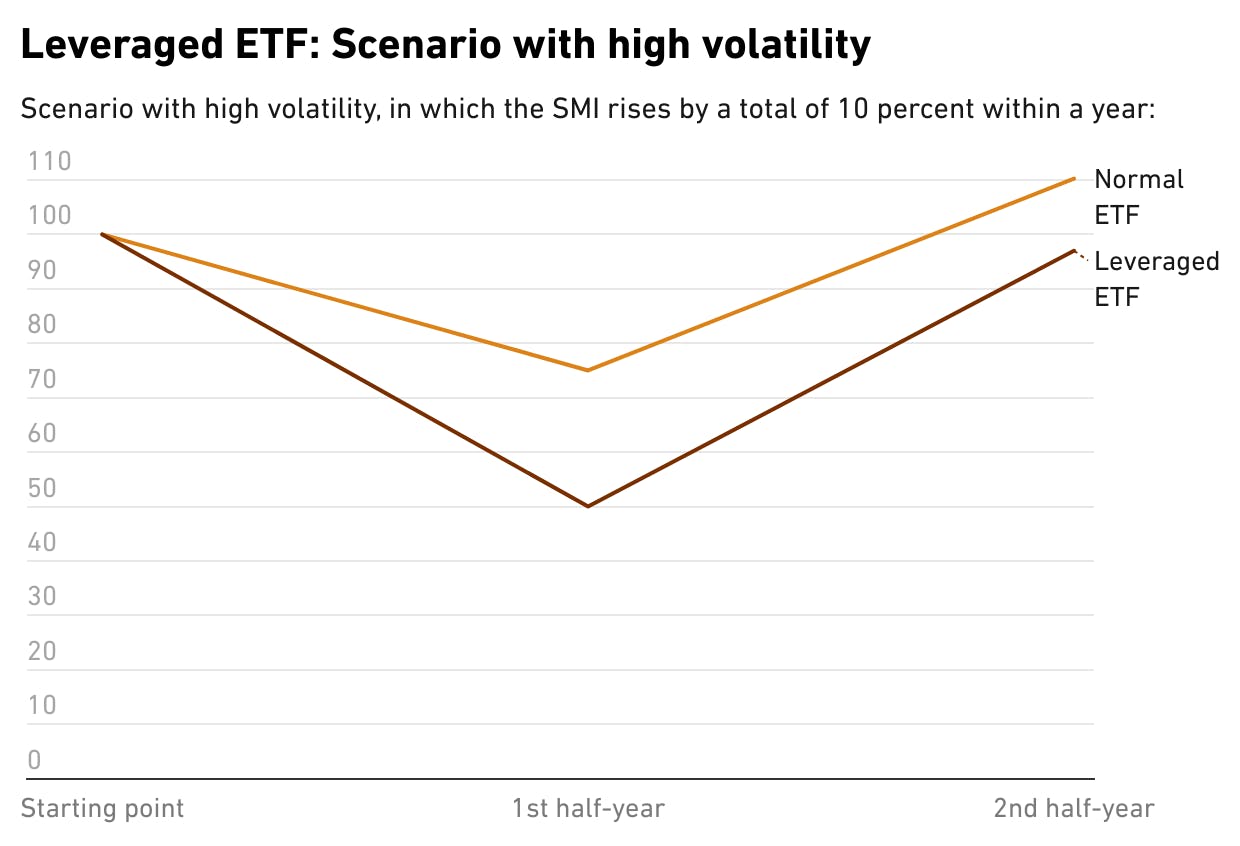

Imagine two scenarios in which the SMI rises by a total of 10 percent within a year:

1. Scenario with low volatility: the SMI rises by five percent in the first half of the year and by another five percent in the second half. This means that the SMI rises from 100 to 105 and then to just over 110 points. (A little more than 110 because of the compound interest effect). With the leveraged ETF, you then have twice ten percent, which at the end of the year yields a whopping 21 percent (the one percent is the compound interest effect).

2. Scenario with high volatility: In this second scenario, the SMI falls by 25 percent in the first half of the year, from 100 to 75 points. However, as is often the case after a crash, the market recovers and ends – as in the first scenario – at around 110 points. From 75 to 110 is +47 percent in the second half of the year. The leveraged ETF would now fall by 50 percent in the first half of the year and rise by 94 percent in the second half. The bottom line is an annual performance of minus three percent. This means that although the (unleveraged) market made a plus of ten percent over the year as a whole, the leveraged ETF made a minus.

The reason the leveraged ETF performs worse is a kind of negative compound interest effect when plus and minus alternate. In technical jargon, one would say that a leveraged ETF covertly generates short volatility exposure.

Incidentally, this effect, of being implicitly invested against volatility when using leverage, has nothing to do with the type of instrument. It can also occur in a leveraged portfolio with Lombard credit. And, by the way, it also occurs with negative leverage, in so-called short ETFs.

For these reasons, it must be said that leveraged ETFs are perhaps suitable for traders with a short-term orientation who know exactly what they are doing. They do not belong in a long-term securities portfolio. Even in a volatile sideways market, a leveraged ETF can suffer losses without the underlying index having lost significant value. In addition, these products usually have higher costs, since derivatives are generally more expensive than classic ETF constructions.

Have you ever used leveraged ETFs yourself and did you understand how they work? Drop me an email.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account