Why Trump only talks about the trade deficit

Trump is imposing steep tariffs on goods imports and excluding services. Long-term investors should not be put off by this. Courageous investors should seize the opportunity and use the lower prices to buy.

Election promises must be kept. With the slogan «Make America Great Again», US President Donald Trump has promised to create more jobs in the USA. More goods are to be produced in the USA again and dependence on foreign countries is to be reduced. In doing so, Trump is addressing his most important group of voters: blue collars. These are the workers in industry for whom Hillary Clinton had nothing but regret and referred to them as «deplorables». According to the motto «America First», import tariffs are intended to make domestic production more competitive.

Industrial goods from Switzerland are also affected and will be subject to a 31 percent tariff. It is true that only 35 percent of Swiss exports to the USA will be affected because important export goods such as pharmaceutical products and refined gold will be spared from the tariffs for the time being. However, there can be no talk of «reciprocal tariffs». As of January 1, 2024, the Swiss Confederation has abolished all industrial tariffs. This means that 99 percent of all goods from the USA can be imported into Switzerland duty-free. Per capita, Switzerland imports ten times more from the USA than vice versa. Switzerland also creates many jobs in the USA. In terms of annual direct investment of almost CHF 300 billion, Switzerland is the sixth-largest investor.

However, the SNB intervenes in the foreign exchange market if the Swiss franc appreciates «too much» in order to protect Swiss industry – from Trump's point of view, this is also a kind of tariff, in which he is probably not entirely wrong.

The US government wants to use tariffs to reduce the trade deficit. A trade deficit means that a country imports more goods than it exports in terms of value. The annual US trade deficit has tripled over the past 25 years: from just over USD 300 billion to over USD 918 billion.

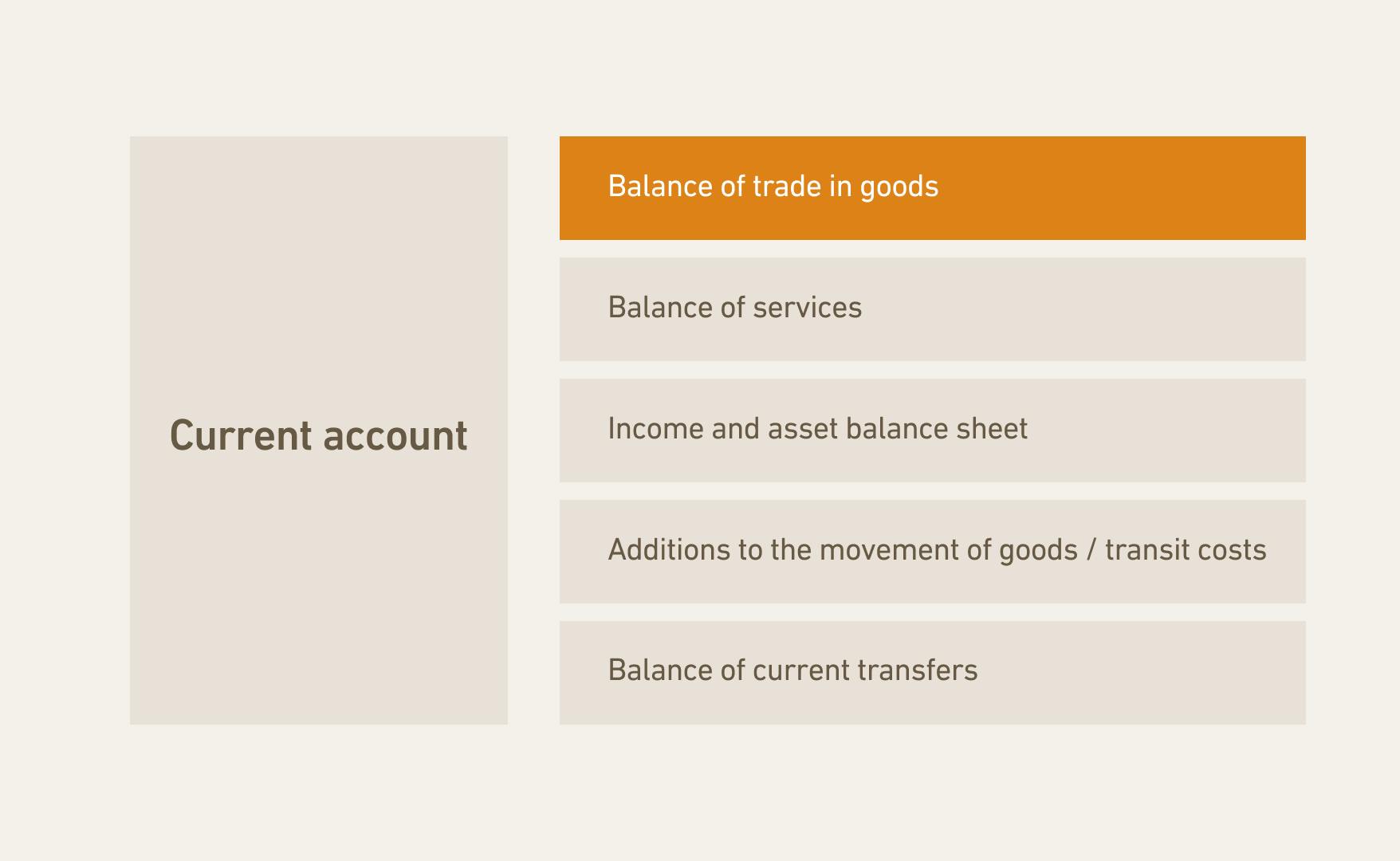

The higher the official trade deficit, the more the narrative of unfair treatment by foreign countries catches on. Trump's protectionist policies and high tariffs seem democratically legitimized. However, the trade balance is only one part of the current account balance. It measures not only the trade in goods, but also services – and as far as services are concerned, the USA exports more than it imports, meaning it has a surplus here that Trump fails to mention.

Overall, however, the US current account deficit of just over USD 1'133 billion in 2024 was even more negative than the trade deficit alone. The reason for this: In addition to the balance from trade in goods and services, the current account balance also includes cross-border earned income, investment income and so-called transfers, i.e. free cash flows. The latter include, for example, remittances from migrant workers to their home countries or donations abroad. Among other things, government transfers in the area of international cooperation increased the US current account deficit in 2024.

But Trump is right about one thing: to put it simply, Americans are living beyond their means. Their economic strength is superior to most other countries in absolute and per capita terms. But this applies even more to their consumption. This is reflected in a current account deficit. And goes hand in hand with constantly rising debt. At the end of 2024, its national debt amounted to 124 percent of its annual economic strength. If interest rates rise, the USA will have a serious problem. The current US administration wants to change this, as Treasury Secretary Scott Bessent confirmed in an interview with Tucker Carlson.

However, even the current account should be treated with caution. This is because it excludes a significant proportion of the services provided by the powerful US technology giants: In Europe, we all consume American services in the form of streaming services and cloud-based apps. Local companies also use cloud services of Microsoft, Google and Amazon.

They do not end up in the US current account. How is that possible? The best example: Alphabet (Google) alone reports a turnover of over 100 billion euros for its subsidiary in Ireland. Meta and Apple are also domiciled there with subsidiaries, while Amazon records billions in income in Luxembourg, another tax-friendly EU country. Profits accumulated in this way only flow into the US current account when the US subsidiaries transfer corresponding dividends to their parent company in the US. The negative current account balance is impressive and feeds the political narrative that the US needs to be more assertive and put trading partners in their place.

Investors should not be unsettled. Political stock markets are short lived. In fact, markets recover in the long term after such shocks. And those who invest with a broad geographical diversification and remain true to their strategy will benefit from global economic growth – tariffs or not.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account