Over 3,000 clients and 200 million assets

True Wealth has developed steadily since its launch in 2014. In the direct client business alone, we now serve over 3,000 clients with assets of more than CHF 200 million. We would like to thank all our clients and take this opportunity to show who our clients are.

“Digital asset management is only for young people”

The digital asset management sector, which is now taken seriously even by banks - the term robo advisor only became established later - was initially confronted with the prejudice that it was just a gimmick for young people. It would hardly catch on with older and generally wealthier customers. An analysis of our customer structure shows a somewhat different picture. Although our client base is much younger than that of a traditional private bank, two thirds of our clients are over 35 years old. More than 6% of our clients have already reached retirement age and are enjoying more of their free time thanks to our intuitive solution.

“Digital wealth management is a retail service”

Initially, many bankers classified digital asset management as a purely retail product due to the low fees. Henry Ford's quote in this context is apt: “You don't get rich by what you earn, but by what you don't spend.” In any case, our data survey clearly shows that 61% of the assets managed by True Wealth come from clients with a portfolio value of over 100,000 Swiss francs. It is important to bear in mind that many clients only invest part of their assets with True Wealth. As a result, we are seeing many clients increase their assets as their confidence grows, and we already count several millionaires among our clients.

The picture is similar when it comes to annual income: 62% of our customers report an annual income of over 100,000 Swiss francs. By comparison, the median salary in Switzerland was just over 78,000 francs in 2016, according to the Federal Statistical Office.

The advantages of digital wealth management therefore appeal to very different investors, regardless of their individual wealth.

“Real professionals don't invest passively”

“Anyone who understands the financial markets actively invests in individual securities at the right time and thus generates a higher return!” This is a common opinion, but is it true? You can read why we are convinced that active investment products mainly generate costs in the long term in our blog “Passive investing: Because stock selection is a matter of luck”.

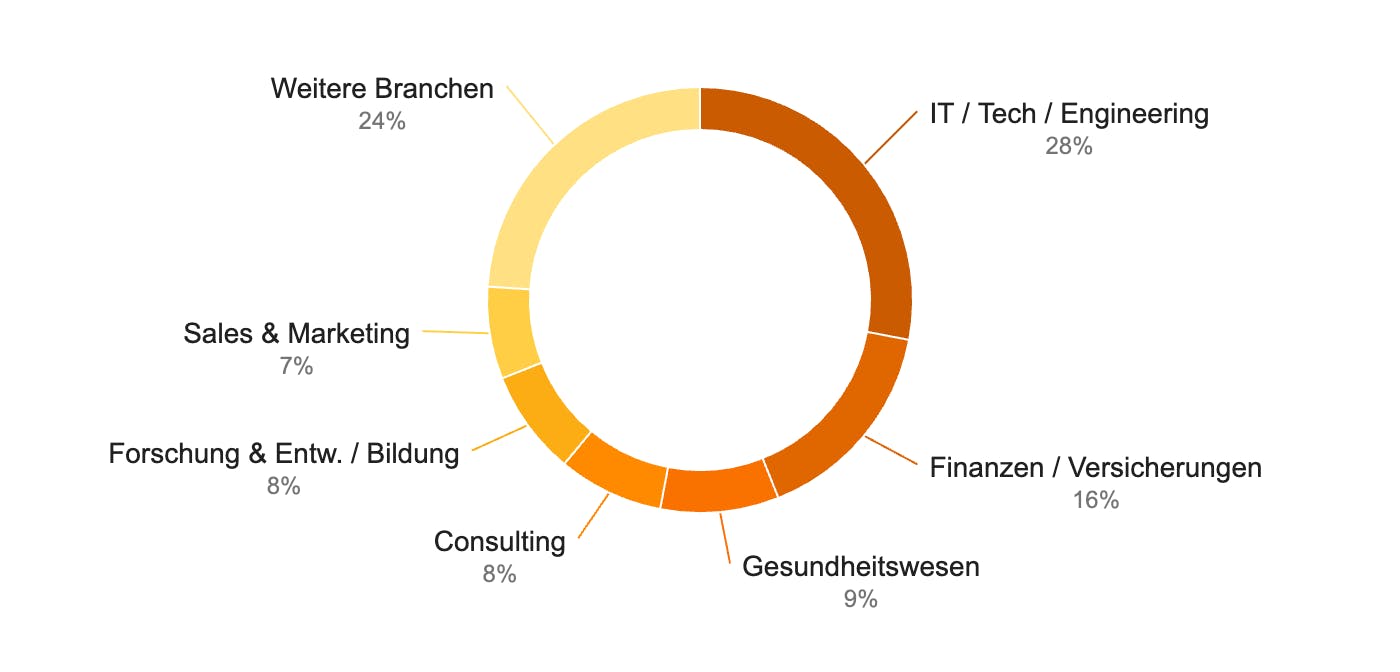

A look at the sectors in which our clients operate is also revealing: Professionals from the financial sector in particular, i.e., banks and insurance companies, are among our first customers and make up our second-largest customer group. Financial professionals very quickly understand the advantages of investing using a diversified ETF portfolio. Only one industry group accounts for an even larger proportion of our clients. A full 28% of our clients work in the IT, technology, and engineering sectors. These sectors are disproportionately well represented, even taking into account their relative importance in the Swiss labor market. Nevertheless, it is not surprising that customer groups with an affinity for technology and finance have quickly become enthusiastic about our services. As a fintech company, we are ourselves a technology company with financial expertise. This is followed by the healthcare and consulting sectors with 9% and 8% respectively.

Sectors of our customer base:

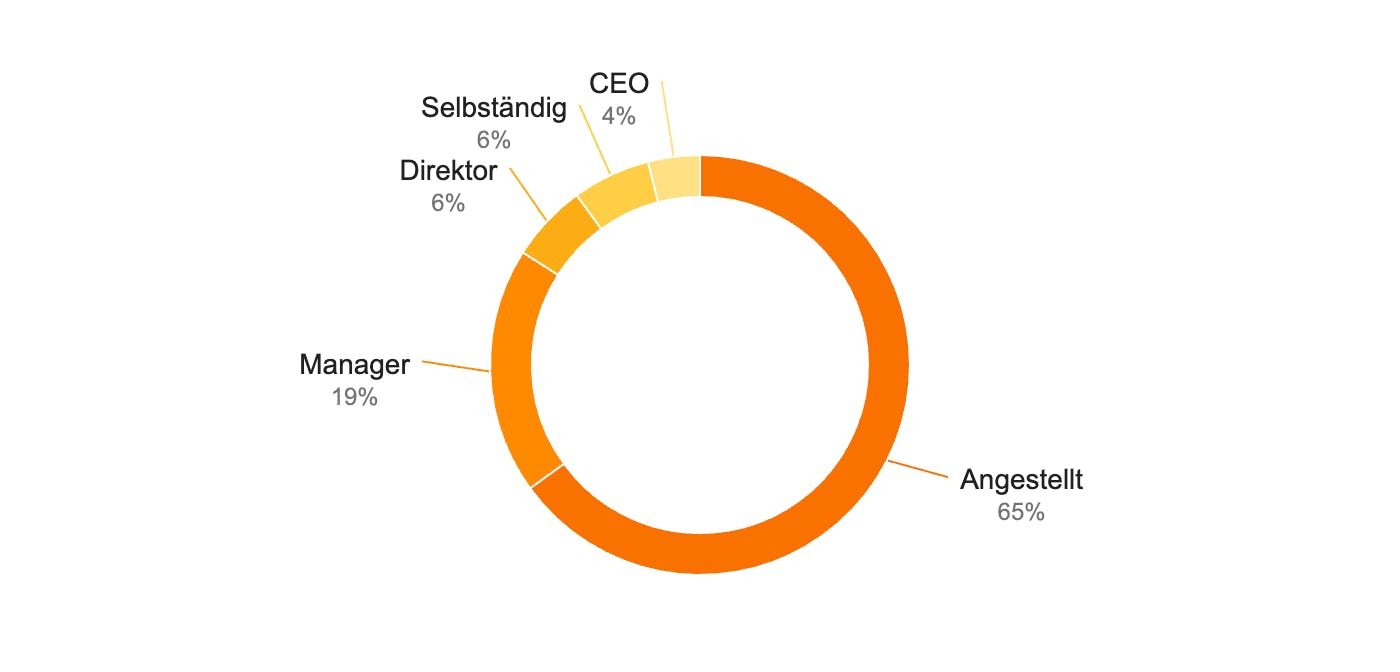

In terms of professional position, more than a third of True Wealth customers stated that they were in a managerial position or self-employed. In other words, people who like to take the reins themselves.

Professional position of our client base:

“The financial sector is not appealing to women properly”

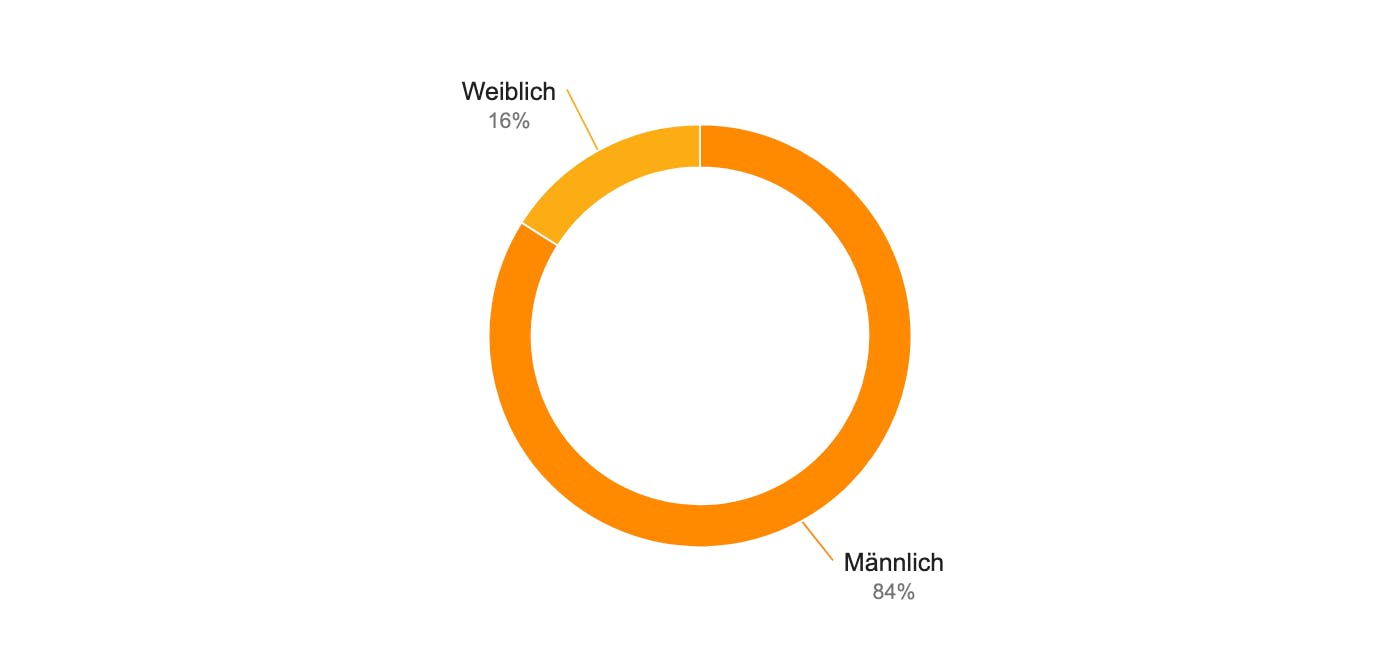

The financial sector has always found it difficult to convince women of the benefits of its services. Right from the start, we set ourselves the goal of creating a gender-neutral platform that would appeal to both women and men. Apparently we were not successful with this either. Only 16% of our customers are female. We have never designed our product according to specifically male or female needs, but we have to admit that our company was able to attract almost exclusively male employees in the first few years. This is probably also due to the fact that men still make up the majority of the workforce in the financial and technology sector. As a result, we are all the more committed to attracting female employees to our company and our vision, and are delighted that around a quarter of our workforce is now female.

Gender of our customer base:

So there is no such thing as a typical True Wealth client. From foresters to investment bankers, from innkeepers to gynecologists, from professional athletes to marketing experts, from househusbands to entrepreneurs and from chief physicians to pension fund experts, we see a kaleidoscope of Mr. and Mrs. Swiss — and of course newcomers. What they all have in common, however, is that they do not allow themselves to be fooled into thinking that they are looking for an intuitive and cost-efficient investment solution.

However, the continuous development of our investment solution and the improvement of the user experience always remain important to us. We look forward to continuing this success story together with our growing customer base. We are therefore always happy to receive your feedback on our blog or our investment solution at support@truewealth.ch.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account