The ETF Boom: Growth for All

From an academic mind game to the standard of the modern investor: the triumph of ETFs brings efficiency and transparency - so you can benefit too.

In the 1970s, the first index funds were still considered a crazy idea. Today, ETFs have arrived in the mainstream. The simple idea of simply investing in an entire share index laid the foundations for the triumph of passive investments. Today, in 2024, a good 30 years after the first ETF and 50 years after the first index fund, they are the boom of the century and have overtaken active investments. And there is no end in sight to this boom, because ETFs are made for the digital age.

From university to Wall Street

Wall Street loves stories about stocks and the companies behind them. There's always a bit of drama in the stories. Especially if you listen to TV hosts like Jim Cramer on CNBC today - but also long before him, even in more serious publications.

In academic research, the idea is gaining ground that all these stories around active management don't do anything. In 1960, Edward Renshaw and Paul Feldstein, writing in the prestigious Financial Analyst Journal, wondered why someone hadn't already set up something they called an "unmanaged investment company."

Such an "unmanaged investment firm" remains a thought experiment for a long time. Later, the term "passive investing" will catch on. And it is not until the 1970s that the first index funds become available to investors.

John Clifton Bogle, known as Jack, was the pioneer. He was an active investor himself for a long time. But then he was fired for the failures of his aggressive active investing. With flying colors, Bogle switches to the passive investor camp. In 1975, he launches the first index fund. His goal: to mirror the performance of an index instead of beating it.

From index funds to ETFs

Many call Bogle the inventor of the ETF. But he did not invent the idea. ETFs themselves also came later. And in the 1960s, Bogle was even openly against the idea with which he later made the company Vanguard so successful.

Nevertheless, the world owes the triumph of index investing to him, as Warren Buffett noted: "If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle."

The index investing success story really took off in January 1993, when the SPDR S&P 500 ETF Trust hit the market. It launched on the New York Stock Exchange, with the ticker symbol SPDR - pronounced “spider”.

The SPDR not only faithfully tracked how the overall market was performing, like other index funds before it. It has also made it possible to enter and exit on a daily basis. That's what the abbreviation ETF stands for - it stands for Exchange Traded Fund.

Bogle's first index funds were still derided as "un-American" by competitors. They referred to his first fund as "Bogle's folly." Today, ETFs are mainstream - among private investors as well as institutional investors.

Growth for decades

Today, ETFs have become indispensable. The ETF market has experienced spectacular growth. Firstly, in terms of the number of ETFs. In 2003, 291 ETFs were traded on stock exchanges worldwide. Today there are 10,303 (as at December 2023). Secondly, in terms of assets under management: from 212 billion US dollars in 2003, they have risen to over 11 trillion US dollars.

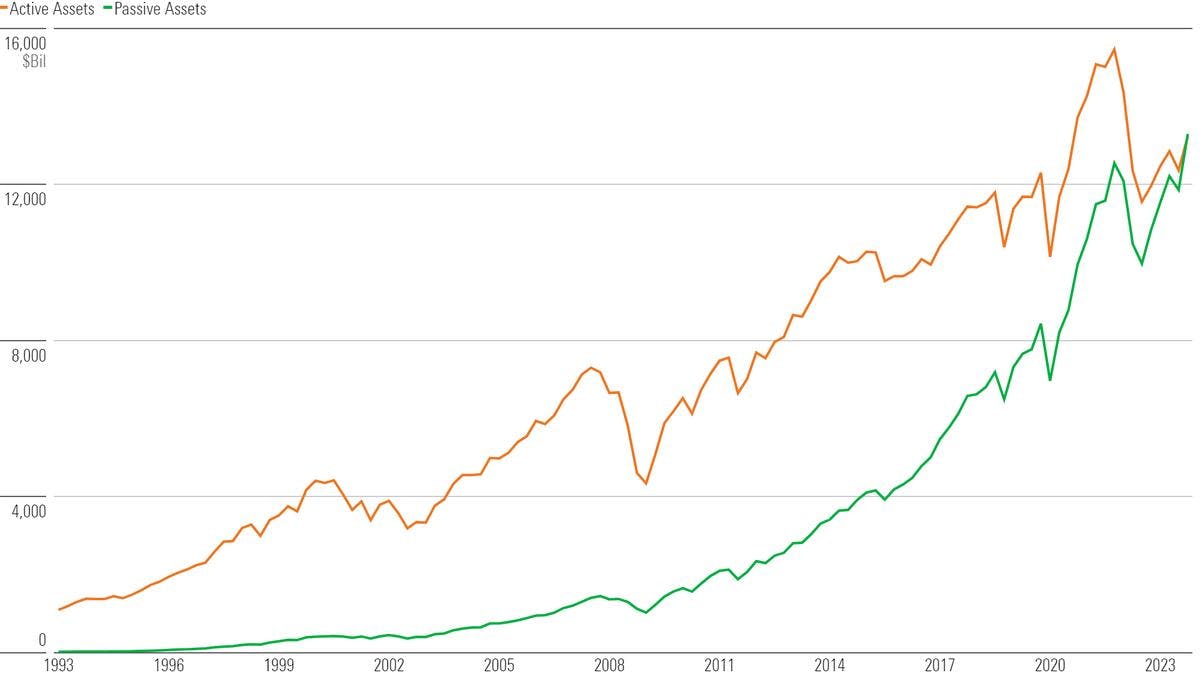

After passive funds had overtaken active funds in terms of new money inflows for years, the top spot changed hands in 2023. In the USA, ETFs and index funds, which together form the group of passively managed funds, took first place.

Fluctuations as in the overall market

Assets under management are not growing quite as steadily as the number of ETFs and are fluctuating more strongly. The bars in the chart clearly show that growth also stalled at times, namely in 2008, 2018 and 2022, which, if you remember, were bad stock market years in each case.

In acute market crises, critics always speak out. They claim ETFs not only reflect overall market pressures, they may even amplify them. In the short term, there is certainly reason for this criticism: The daily tradability can tear holes in liquidity if many people want to sell at the same time. Especially dangerous are tight stops, as we have already written in a previous blog: Investing with ETF: Stops are for traders only.

On a longer horizon, these concerns are less important: after every crisis, market indices have recovered. And along with the indexes, so have the assets managed in ETFs. It is this ability to recover that long-term investors are banking on. And that's what we're aiming for with the portfolios we build for our clients at True Wealth.

Active management is worse than its cost

In the 1960s, Edward Renshaw and Paul Feldstein had only a limited set of data. Today, many renowned institutes regularly study the performance of funds. Time and again, they find that the majority of active managers underperform. Their funds lag behind the indices they claim to beat.

SPIVA, the research department of S&P Global, paints the following picture for mid-2023: In the first half of 2023 alone, 60% of actively managed US funds underperformed the S&P 500; over the 10-year period under review, the figure is already over 85%.

The reason why active funds regularly underperform is primarily due to costs. The performance itself, before fees, is usually neither particularly good nor particularly bad. However, if you subtract the excessive fees, the hard truth becomes clear: expensive active management is not worth the money. That's a big reason for the boom in ETFs.

The ideal instrument for the digital world

The other main reason for the ETF boom is digitalization. In the past, you had to make an appointment with a financial advisor if you wanted to invest in the stock market. Today, a smartphone is enough. And maybe you don't use a bank's app, but one of the many neobrokers? In short: you can buy and sell ETFs anywhere.

You can find up-to-date information about ETFs on the internet at any time, usually free of charge. ETFs are wonderfully transparent, so you can inform yourself independently. With a little effort, you can find the ETFs that suit your goals from the more than 10,000 available. Unfortunately, it is not as easy to build a well-diversified portfolio from these ETFs.

Many investors around the world therefore rely on robo-advisors. This new class of online wealth managers has been around for ten years. They automate portfolio management. This service used to be reserved for private banking clients. Because they rely on low-cost ETFs, robo-advisors can now make professional asset management affordable even for small assets.

Added to this is the growing popularity of ETF savings plans in Switzerland, which are significantly cheaper and more flexible than fund savings plans. With the initial investment, you lay the foundation for wealth accumulation. With an ETF savings plan, you ensure an even stronger compound interest effect over a longer period of time at low cost and automatically.

At True Wealth, we invest professionally for you from CHF 8'500. And for your Pillar 3a or the ETF portfolio for children from as little as CHF 1'000. If you want, you can test how well it works virtually beforehand - without investing a single franc of your own money.

An earlier version of this article was published on 06.06.2023.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account