#25 Cash is the most expensive asset class

Cash doesn't belong under your mattress or in your portfolio. Find out why in the following article.

Cash is the most liquid asset. In the narrower sense, «cash» refers to coins and banknotes. In a broader sense, however, the term also includes cash balances in bank accounts. Most cash in circulation today is in electronic form.

Functions of cash

Cash fulfills three main functions:

- Cash is a medium of exchange that facilitates the exchange of goods and services.

- Cash serves as a store of value by offering the possibility of parking assets.

- Cash acts as a unit of account that quantifies economic transactions.

Who supplies the economy with money?

Supplying the economy with money is one of the most important tasks of central banks. In Switzerland, only the Swiss National Bank (SNB) is authorized to issue banknotes denominated in Swiss francs. The SNB creates central bank money, which it credits to the banks for purchases of gold, securities or foreign currency. These bank reserves at the SNB are also known as sight deposits. However, most of the money in circulation is not created by the National Bank, but by the commercial banks through lending. This is because lending multiplies the National Bank's money supply. This newly created money is also called «book money».

Virtually guaranteed loss of value

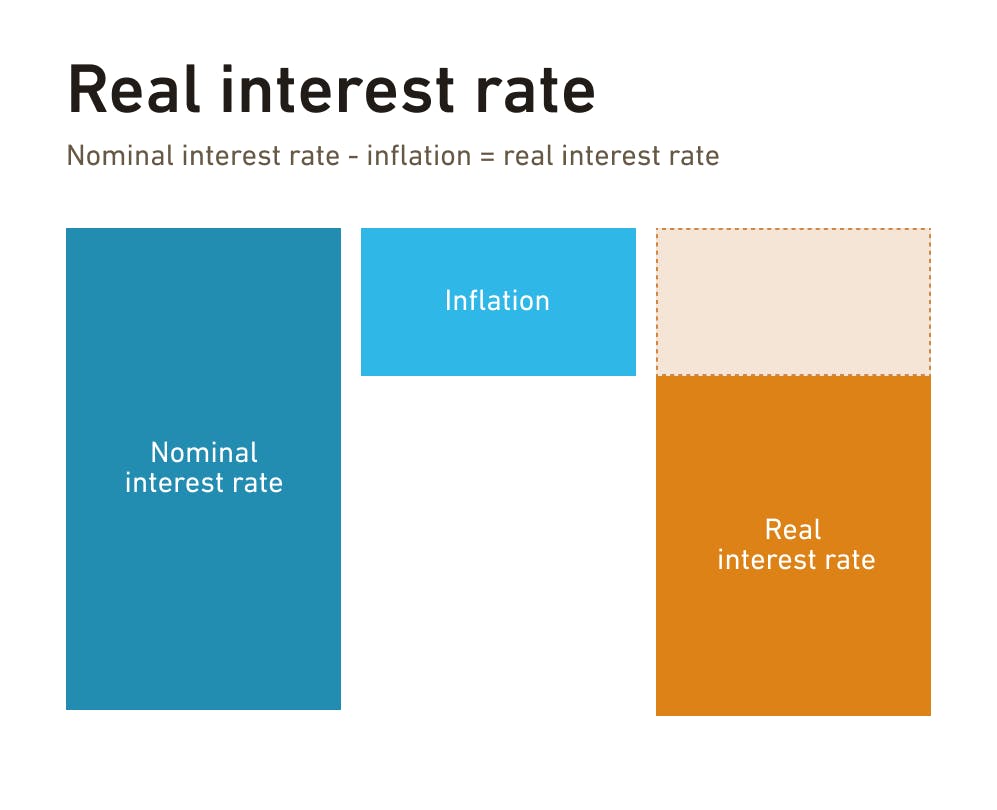

Cash is the safest form of investment in the short term. The probability of losing money with a bank account at a solid bank is low – at least if you ignore inflation. The problem with cash is that the return is also low. In the long term, cash is the asset class with the lowest return. The decisive factor here is the real interest rate. The real interest rate is the interest rate for an investment taking into account the loss of purchasing power due to inflation (real interest rate = nominal interest rate - inflation). The real interest rate can be both positive and negative.

Advantages and disadvantages of Cash

Advantages of cash

- Liquidity: Cash is the most liquid asset, as it is immediately available and there are no transaction costs.

- Security: In short-term periods, cash offers a high level of security. The probability of losing money with a bank account from a solid bank is low.

- Low volatility: Cash is not subject to volatility, as is the case with shares or other forms of investment.

Disadvantages of cash

- Inflation risk: Cash continuously loses purchasing power due to inflation. If inflation exceeds interest income, this results in a negative real interest rate.

- Low returns: In the long term, cash offers the lowest returns of all asset classes. Historical data shows that equities, real estate and bonds achieve better returns.

- Opportunity costs: By holding cash, you miss out on potential gains from other forms of investment. Assets are not optimally increased.

- Political risks: The high national debt of many countries creates incentives for governments to keep the real interest rate slightly negative over the long term in order to reduce debt at the expense of savers.

Cash in the context of your portfolio

At True Wealth, we hold four cash accounts in Swiss francs and foreign currencies for our clients in order to minimize currency exchanges when buying and selling ETFs in the same currency. This saves friction costs. In our optimized strategies, however, the cash component is reduced to the technical minimum of one to two percent so that you are invested to the maximum.

The main reason for minimizing the cash component in a portfolio is that other asset classes offer better long-term returns. Stocks, bonds, real estate and other asset classes have historically not only offset inflation, but have also delivered real gains. With a broadly diversified portfolio, you can take advantage of the return opportunities offered by different asset classes while minimizing risk through broad diversification.

Conclusion

In summary, it can be said that cash is safe and liquid in the short term, but is an expensive asset class in the long term. The lower returns and continuous loss of purchasing power due to inflation make it a less attractive option for long-term wealth creation. While cash plays an important role in day-to-day financial management and offers short-term security, the majority of your portfolio should be invested in assets that offer better returns and growth potential. Don't keep your money under the mattress or exclusively in your bank account, but invest it wisely to build wealth for the long term.

Are you still holding your money as cash in your bank account, or are you already invested in securities? Write me an e-mail.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account