Corona crisis investor behavior

High cash inflows at True Wealth due to low share prices

Many investors see the falling share prices as an opportunity to enter the market. True Wealth recorded around twice as many new clients in the first week of March as in the previous period.

«We are somewhat surprised by the high demand for our services, as we expected investors to withdraw when prices fall,» says True Wealth CEO Felix Niederer. And he continues: «However, it turns out that the typical True Wealth client is a considered investor who does not sell in a panic but, on the contrary, makes more funds available to acquire investments when prices are favorable,» says the co-founder of the online wealth manager.

Oliver Herren, the second founder in the group, refers to a quote from Warren Buffet: «We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.»

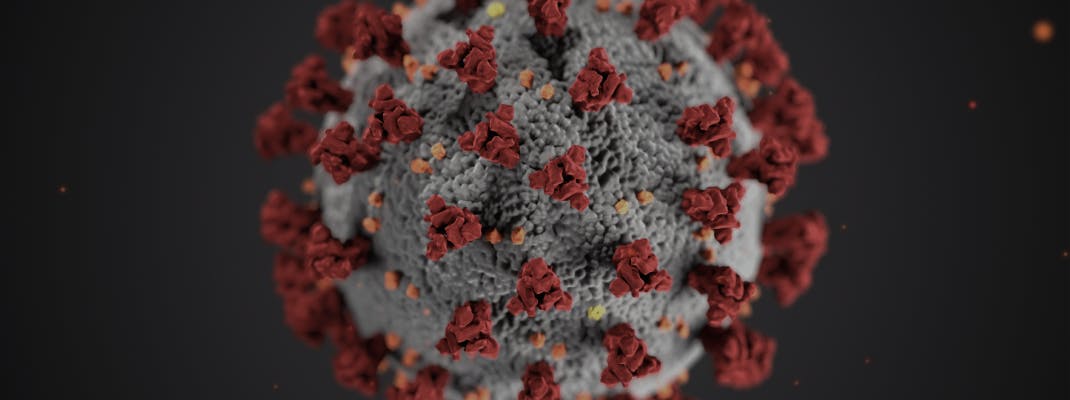

The current market situation is undoubtedly a consequence of the rapid spread of the coronavirus, which will now put our healthcare system to a difficult test. As a company, we at True Wealth are also called upon to contribute to overcoming this global health crisis with our behavior. However, as almost all our work processes are paperless, working from home is manageable for us as a company.

True Wealth was founded in 2013 with the aim of offering user-friendly and transparent online wealth management. Today, True Wealth manages around CHF 250 million in client assets from over 4,000 clients on its own platform truewealth.ch. True Wealth invests in ETFs for its clients. Two investment universes are available for this purpose: the broadly diversified «Global Universe» and the «Sustainable Universe», which is compiled according to sustainability criteria.

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account