"Back the most sustainable companies in the world"

Finally investing sustainably with ETFs

Thanks to new ETFs, you can invest in a more environmentally friendly and socially responsible way with True Wealth. Automatically as usual – but only in companies that operate sustainably.

Not a day goes by that we at True Wealth are not asked: Can't we also invest sustainably with you? No question: investing in a way that doesn't harm the environment or people – that's the trend.

Sustainability in vogue

The volume of sustainable investments has grown strongly in recent years: to CHF 266 billion in 2016, with growth rates of almost 40 percent per year. This trend has so far been driven primarily by institutional investors such as pension funds.

No wonder: many sustainable funds were only approved for institutional investors. But exchange-traded investment funds (ETFs) are slowly appearing, including on Swiss equities, since September 2017. Sustainable investing is now finally possible without active management – with the usual low costs associated with ETFs.

A clear conscience with good returns

Hardly any investor wants to forego returns. Institutional investors can't even afford it: they have to be able to argue with figures – not just with a clear conscience.

This is exactly how the world's leading companies feel. The more their customers ensure that products are environmentally friendly and that working conditions are fair, the more their success depends on public perception.

So responsibility and returns go hand in hand: only those who do good – or at least refrain from the worst deeds – make good profits.

That's why you shouldn't have to compromise on returns with sustainable investments. You can also expect good long-term returns with sustainable investments – but not that companies will suddenly become saints.

Returns using the example of selected MSCI SRI share indices (annualized net total return in CHF)

Greener and more social

But how exactly does this sustainable or impact investing work? At True Wealth, we remain true to our approach: the most important thing is that our clients do not lose any unnecessary fees for active management. That's why only ETFs are considered for investment. But how do we then make qualitative decisions about how well individual companies operate sustainably?

We don't do it at all. Screening according to clear criteria makes it possible to calculate how many karma points the individual companies collect. This screening is carried out by well-known index providers such as MSCI. The American ranking agency - which is also a leader in the evaluation of emerging markets - has done a great job of ranking companies according to environmental and social compatibility.

This has resulted in two index families at MSCI: Socially Responsible Investing (SRI) and Environmental, Social, Governance (ESG). Both are based on the same thorough screening of companies. This is also called ESG - and, like the index, stands for environment, social and governance.

Even more social is also more environmentally friendly

It is confusing enough that the same screening produces two different indices. But it's good to know that all criteria are always used for the ranking in both indices.

In the ESG index (which has the same name as the ranking), the provider MSCI admits the better half of the companies. In other words, all companies that take more responsibility for the future of the world than the other half.

The SRI index, seemingly named Socially Responsible Investing only after social responsibility, uses exactly the same criteria. And it is even stricter: only the best quarter (within an industry sector) of all companies are welcome here.

This is more socially responsible in name – the funds are called Socially Responsible Investing ETFs, just like the index. But in fact, these ETFs are also greener.

So not everyone involved is perfect. Whether equities or bonds – the investments in the ETFs come from the companies that behave best. This is relative and does not mean that they are flawless in all respects. But at least with the SRI indices you are investing in the world's most sustainable companies.

Screening in three stages

How does MSCI filter out which companies operate sustainably? The screening consists of three stages:

Business lnvolvement Screening – Are the companies doing business that is socially or environmentally damaging? These include: Weapons, alcohol, gambling, nuclear power, tobacco, pornography and genetic engineering. This level of screening is negative: companies that generate too much turnover in these areas are excluded.

lntangible Value Assessment (IVA) – Do the companies act according to good values compared to others in their sector? MSCI assigns a rating from CCC to AAA. This screening is positive: those that behave better are given a better ranking. Only companies that receive at least an A for their actions are included in the share indices.

Environmental, Social, and Governance Contoversies – Companies that violate international rules and standards are downgraded. MSCI looks at the areas of environment, governance, customers, human rights, community, and labor rights and supply chain. For a company to remain in the index, its score must not fall below 4.

One ranking for all criteria

MSCI uses the same criteria from the ESG catalog for the positive evaluation according to their values and the penalty points for controversies. This is what MSCI looks at in detail in terms of environment, social, and governance:

Environment – Does the company invest in renewable energy? Does it use energy and raw materials efficiently? Does the company produce in an environmentally friendly way? Does it generate only low emissions to air and water? Does the company have comprehensive climate change strategies?

Social – Does the company comply with key labor rights, such as the ban on child and forced labor and the principle of non-discrimination? Does it have high occupational health and safety standards? Does the company ensure fair working conditions, appropriate remuneration and training and development opportunities? Does the company offer freedom of association and trade union freedom? Does the company enforce sustainability standards with suppliers?

Conduct– Does the company take transparent measures against corruption and bribery? Is sustainability management anchored in the management and board of directors? Is the remuneration of the Board of Directors linked to sustainability targets? How does the company deal with whistleblowing?

Selection of companies

None of the criteria is an absolute exclusion criterion. But taken together, they help to reliably select the shares and bonds of the best companies for an investment. At True Wealth, we use the stricter selection from the SRI indices for sustainable equity investments. These allow you to invest in the best 25 percent of all companies.

But let's not delude ourselves: The MSCI World SRI also includes McDonald's and Nestlé, among others, which are definitely the subject of controversy in the press because of some of their business practices.

You can check which companies are included in the indices at any time at MSCI.

The proportion of companies included in the index depends on their size. As with other indices, the individual shares are weighted according to their market capitalization.

Sustainable investing: a fundamental decision

Not every traditional ETF already has a sustainable counterpart. So in purely practical terms, we cannot simply replace individual ETFs with sustainable ones at the moment. But perhaps there will be soon – because the market for sustainable investments is growing rapidly.

The sustainable universe also still has shady niches: Although all equity investments are already selected according to sustainable criteria. But when it comes to bonds, there are currently only a few sustainable ETFs, such as one on European corporate bonds. There are still no sustainable ETFs for other bonds such as government bonds and real estate investments – but hopefully soon.

Our proposals do not include commodities. There is no sustainability ranking for this asset class that we can believe in. And we fear it will stay that way. However, if you wish, you can add commodities to your portfolio individually.

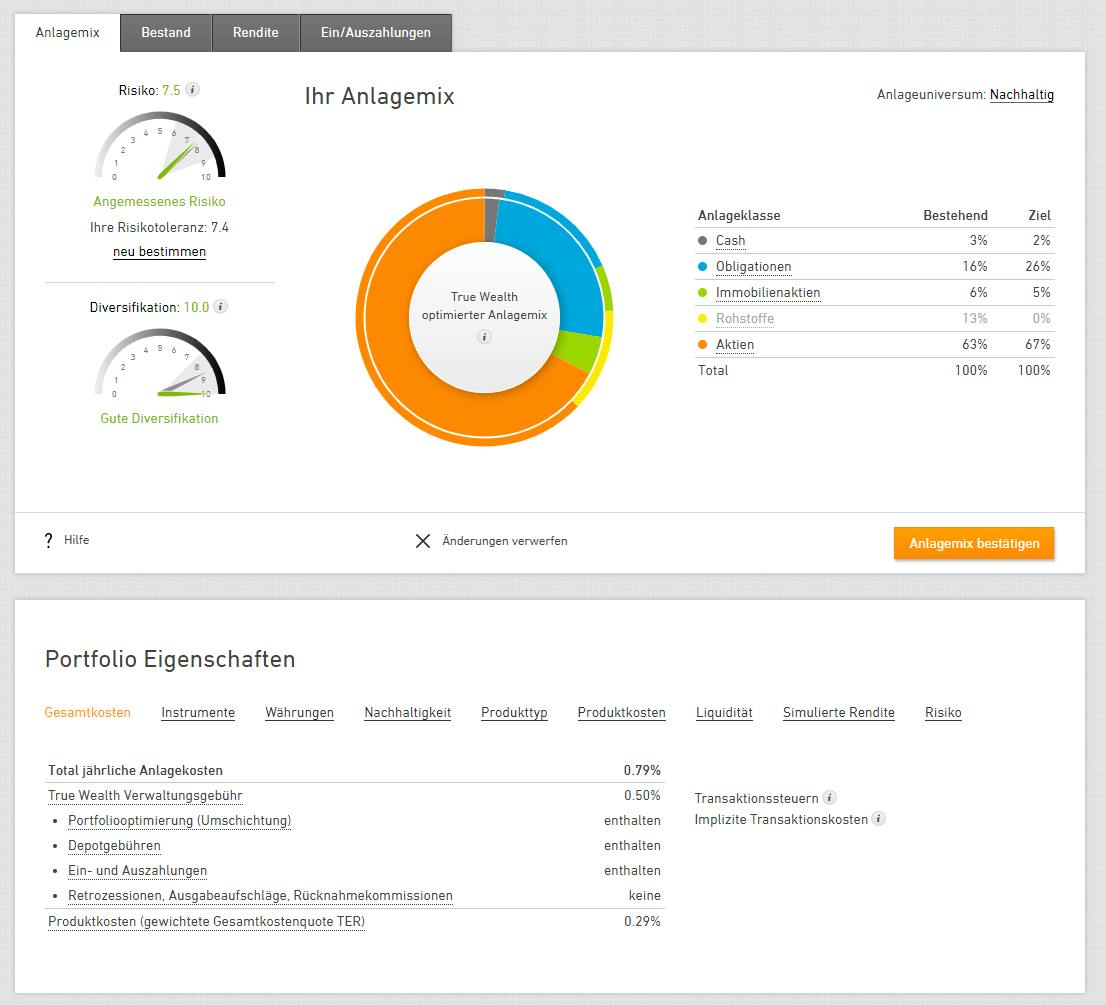

With us, the decision to invest sustainably is therefore made at portfolio level:

For the “Global Universe” – this contains all the traditional ETFs we have used to invest for our clients to date.

Or for the “Sustainable Universe”. This only contains traditional ETFs if there are not yet any sustainable ones for an important asset class.

If you are creating a portfolio with us for the first time, you decide on the investment universe beforehand. If you already have a portfolio with us and want to invest sustainably for the first time, then there is no way around changing it completely.

Does sustainable investing cost more?

Yes, unfortunately. But fortunately not much. The returns of the sustainable indices are not inferior to those of their traditional siblings, as we have already seen above. Screening is time-consuming and has to be repeated regularly. The providers of sustainable ETFs add these costs to the fees – on average, they are therefore around 0.15 percent more expensive than traditional ETFs. In terms of the total expense ratio (TER), however, they are still considerably cheaper than sustainable funds with active management.

We take care of the fundamental conversion of the investment universe and the individual adjustment of your personal investment mix for you free of charge. The fees for this are already included in the asset management fee. Please note, however, that portfolio reallocation may reduce your return slightly on the day of the reallocation due to trading spreads.

Are you ready for sustainable investing?

The changeover begins with a click in the top right-hand corner. Before, it will say “Global” – after the switch is complete, it will say “Sustainable”.

As you can see: This is as transparent as you have come to expect from us. Regardless of whether you are already investing real money with us or are currently using a test account.

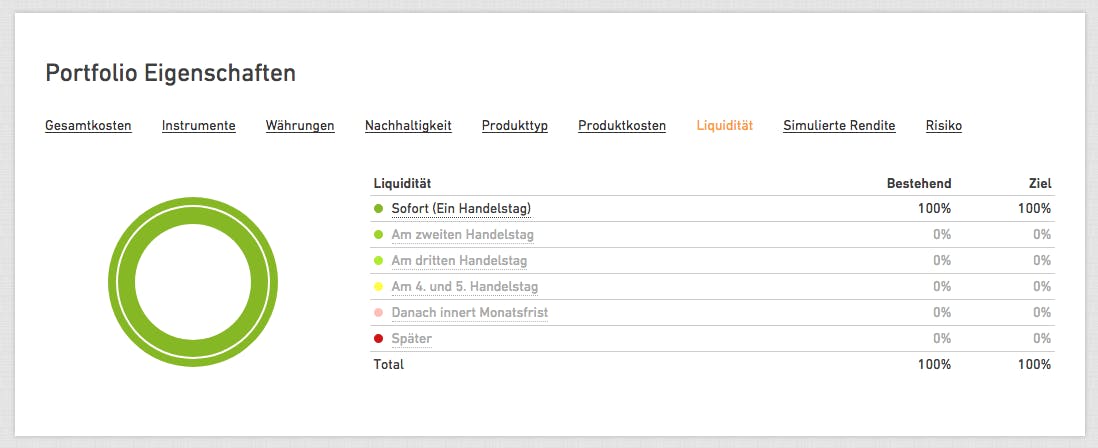

Not quite as liquid

The decision in favor of the sustainable universe also has an impact on the liquidity of your portfolio. ETFs on the major indices such as the MSCI USA SRI are traded daily in high volumes on the stock exchange. Such a volume is not yet available for the MSCI Switzerland SRI. If you are already invested sustainably, it may take a few days longer for us to sell your holdings. If you are a new investor in the sustainable universe, it may take a few days longer for all investments to be purchased. You can see how long by clicking on the keyword "Liquidity" in the bottom tile.

Try it out without obligation

The best thing to do is to try it out for yourself. In your True Wealth account, you can compare costs, liquidity, and everything else in detail before you decide to switch to the sustainable universe. And with a test account, you can try out all the functions without spending a single franc of your own money.

Links

- MSCI: The companies that are included in the index

- True Wealth: Sustainable investment

About the author

Founder and CEO of True Wealth. After graduating from the Swiss Federal Institute of Technology (ETH) as a physicist, Felix first spent several years in Swiss industry and then four years with a major reinsurance company in portfolio management and risk modeling.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account