Investing with ETF – for the first time for children and teens

Press Release

Zürich, 21.09.2023

True Wealth is the first independent wealth manager to launch an ETF-based investment solution for children and young people. The innovative product extension is aimed at parents and relatives who want to make the benefits of long-term securities investment available to their children.

True Wealth launched 10 years ago to revolutionize digital wealth management. From the beginning, True Wealth's pioneers relied on fully automated processes, the innovative and transparent app solution, and they doggedly followed one principle: the cost of wealth management should not get in the way of returns for clients. Neither for adults nor for children.

Launching the children's portfolio

"After an extensive development and testing period, we are pleased to announce the birth of our newest baby: Portfolios for all children and young people up to the age of 17," says a delighted CEO Felix Niederer. "This innovation builds on all the proven principles of our transparent and cost-effective wealth management solution."

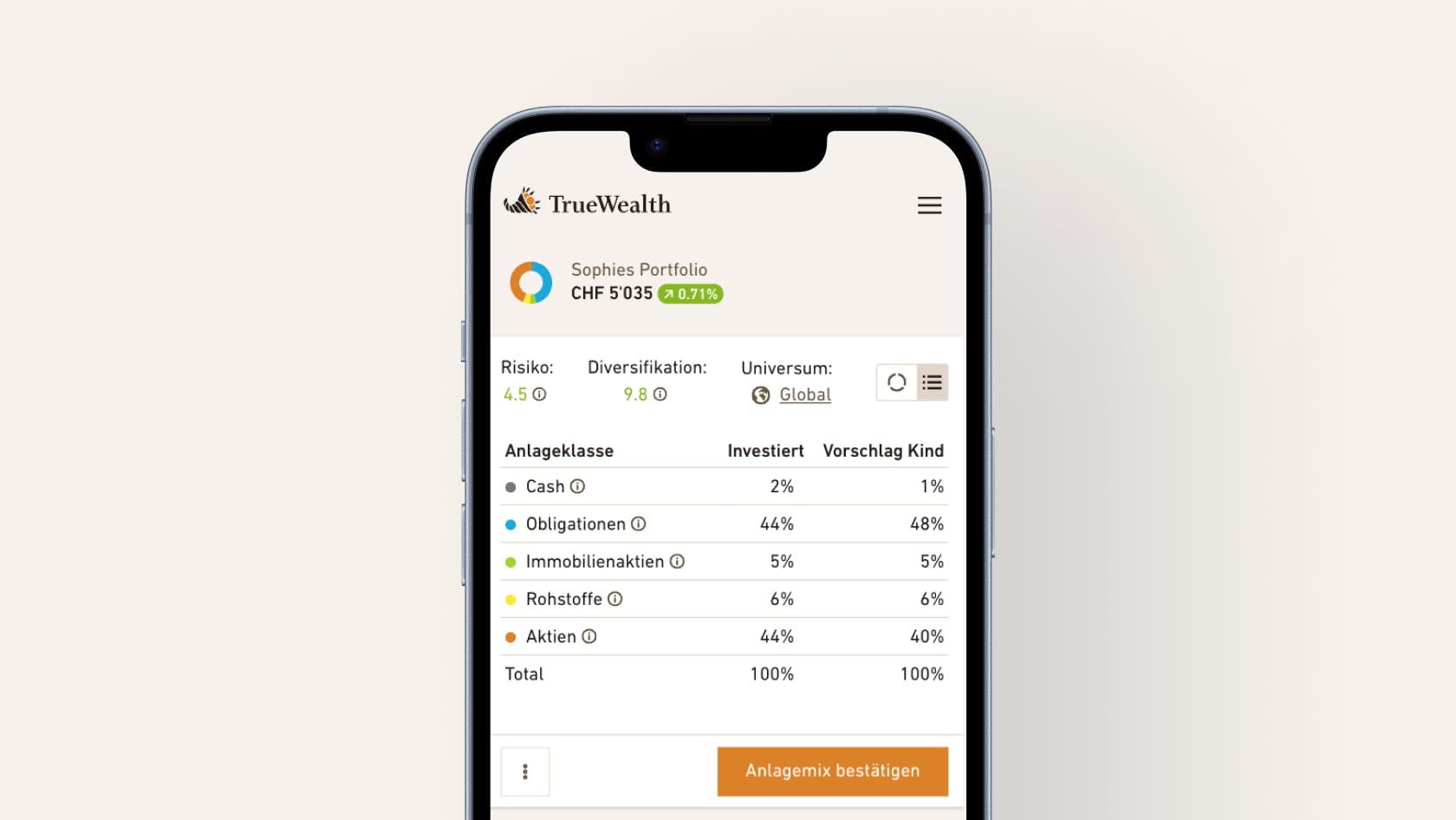

Parents can open a separate children's portfolio for their offspring with an individual strategy and ETF as the building blocks of securities investment. The assets are held in a separate children's account – in the child's name.

Oliver Herren, co-founder of True Wealth, adds, "Having a separate, legally protected account for the child was crucial for us, because a lot can happen in 18 years. And everyone who pays into the child's account ultimately wants to be sure that the money really belongs to the child."

Financial education for the next generation

The True Wealth children's portfolio offers another unique innovation: parents can set up a separate login for their offspring.

"The investment strategy is determined by the parents, but once the child is capable of judgment, parents can involve them in the decisions," Niederer explains. Like everything else at True Wealth, this is done conveniently and easily online. "This way, children and young people can experience the market development of their portfolio live and become familiar with volatility. Because what wants to grow for a long time does not develop linearly upwards," Niederer continues.

Oliver Herren adds: "Some things are best learned through experience. That's why children are also allowed to make their own investment suggestions, although their parents always have the final say."

The two company founders, both family men, agree that there is a lot of catching up to do in terms of financial education in Switzerland and that a child portfolio can make an important contribution to closing this gap.

Long investment horizon

Anyone setting aside money for children should take their long investment horizon into account. With an investment horizon of up to 18 years, the advantages of a securities-based investment solution become particularly apparent: the longer the investment horizon, the more the relationship between risk and return shifts in favor of return when investing in the capital market.

It should also be borne in mind that although bank accounts offer an interest rate, this is almost always below the rate of inflation. For the long-term preservation of purchasing power, everyone should therefore consider making the advantages of ETF-based portfolio solutions available to their children as well.

Easy to get started

Existing True Wealth clients can open a separate portfolio for their child in their login area. However, True Wealth’s child portfolio can also be created without being a customer. The account must be opened by the legal representative, i.e. the mother or father.

More information about True Wealth's child portfolio offering

About True Wealth

True Wealth was founded in 2013 by Oliver Herren, co-founder of Digitec Galaxus AG, and Felix Niederer, physicist and portfolio manager. The online platform has consistently automated all processes of modern wealth management and offers clients domiciled in Switzerland a cost-effective wealth management solution from an investment amount of 8'500 Swiss francs or 1'000 Swiss francs for child portfolios and investments in pillar 3a.

The company manages client assets in excess of one billion Swiss francs. The annual all-in asset management fee is 0.25-0.50%, depending on the investment amount. For pillar 3a, the management fee is 0%.

Press and interview requests

Contact True Wealth for press and interview inquiries at press@truewealth.ch.

Press photos, logos and other documents are available for download here.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account