Maximum convenience and return

for your Pillar 3a

Investing in the third pillar is simply a must.

It saves you taxes year after year, no matter which provider you choose.

We say: that's great. But it could be so much better!

Your advantages with 3a from True Wealth

Pillar 3a in a nutshell

- More money in retirement

With Pillar 3a you can improve your pension and secure more wealth for retirement. - Save taxes up to the maximum amount

You are allowed to deduct the amount paid in from your taxable income. - Early withdrawal for home ownership

If you live in the property yourself, you can use Pillar 3a funds to finance or amortise it. - Variable deposits

You determine the amount you pay into Pillar 3a yourself. - Flexible cash out

You can withdraw your funds five years before reaching AHV age.

The tax treatment of pension contributions and pension assets depends on individual circumstances and may change in the future. Tax laws are subject to constant political change. Therefore, the further in the future the date of taxation is, the greater the probability that the legislator will have changed the taxation by then. True Wealth does not provide legal or tax advice and makes no representations regarding the tax treatment of assets or their investment returns.

Investing better automatically

We ask all the questions needed to make a good decision. Then our algorithms ensure that everything goes as planned. Three steps are all it takes, and you're already investing better. In both free assets and Pillar 3a.

The leading Swiss Robo-Advisor

- More than 30'000 invested clients

- Over CHF 1.7 billion assets under management

- Award-winning digital user experience

- Excellent customer service

- No lock-in, no minimum duration

Invest simply as of today

For free assets and tied pension provision. With us, one account is enough for everything.

Pillar 3a should not cost a thing

Whether you are employed, freelance or an entrepreneur: We want to introduce you to sound, long-term investments and support you in building up assets. With your Pillar 3a, you can learn free of charge how well professional asset management can work for you.

- Favourable for us, favourable for you

Technology is productive. Everyone saves time with it, both you and us. And because we save time, we also save costs. We pass on this advantage. In the third pillar, we do not charge any fees at all – we keep them as low as possible for your free assets. We also use only low-cost ETFs and index funds as investment vehicles, many of which are exempt from withholding taxes. - «Seven times cheaper than average retirement funds»

On average, Pillar 3a apps are significantly cheaper than traditional retirement funds. In the case of True Wealth, the total costs are just 0.15 percent per year. This makes True Wealth seven times cheaper than an average retirement fund.

This is not said by True Wealth, but by the online comparison service Moneyland. - Whoever convinces does not need to sell

We believe: If you manage your third pillar with us, then sooner or later you will also entrust us with your free assets – this saves us advertising costs, which we prefer to spend on a better return on your pension provision. We charge a small fee for the free assets, but even this is extremely competitive thanks to automation. - Fewer fees, more return

It has been scientifically proven: You achieve the highest returns over the long term if you keep investment costs low at all levels. Despite this, some providers charge outrageous fees for investments in equities – but not True Wealth.

Only manual special cases cost a fee: More complex withdrawals require elaborate checks: If you prematurely terminate your third pillar for emigration, home ownership or self-employment, then we have to charge you for this effort.

Stagger correctly automatically

The third pillar also incurs some taxes – but this only occurs later on, once the money has been withdrawn. It takes many years until then, many think. And that's how expensive mistakes arise. We make sure that you automatically get everything right.

Breaking progression

Like income tax, taxes on third pillar withdrawals are progressive. Those who withdraw more pay disproportionately more. This can be countered: Do not withdraw everything at once. The law allows you to withdraw a pension account five years before you reach AHV age.

Keeping five accounts

The pitfall: Each individual Pillar 3a retirement savings account must be paid out in one go. If you want to withdraw in five staggered installments, you have to open five accounts early on – even with the same provider.

Balancing the accounts

Ideally, all accounts should have the same balance when it comes to payouts. One account is therefore opened and topped up each year until a total of 5 accounts have been set up. From the 6th year onwards, the 3a payments are made into the account with the lowest balance. External 3a transfers are retained as an additional account. More on this in the FAQ.

Efficient transfer

When you transfer assets from other providers, we automatically book them in the best way: To a new, empty sub-account.

How many Pillar 3a accounts are useful?

Tax practice on the withdrawal of pension assets differs from canton to canton. For example, in addition to the direct federal tax, some cantons also apply a tax progression to lump-sum benefits from the pension scheme, but not all. With regard to progression, the tax treatment of staggered withdrawals also varies from canton to canton. If necessary, enquire with your tax authority in good time. With our solution, we try to ensure you maximum flexibility in later lump-sum withdrawals, even if you don't yet know which canton you will later withdraw your pension assets from.

Never miss a benefit

For free assets and tied pension savings: With True Wealth, one account is enough for everything.

Start now with Pillar 3a.

Put us to the test

True Wealth not only has the lowest fees in Swiss wealth management. We are also ahead on all other points. The best thing is to compare for yourself:

Pillar 3a holistically integrated into asset management

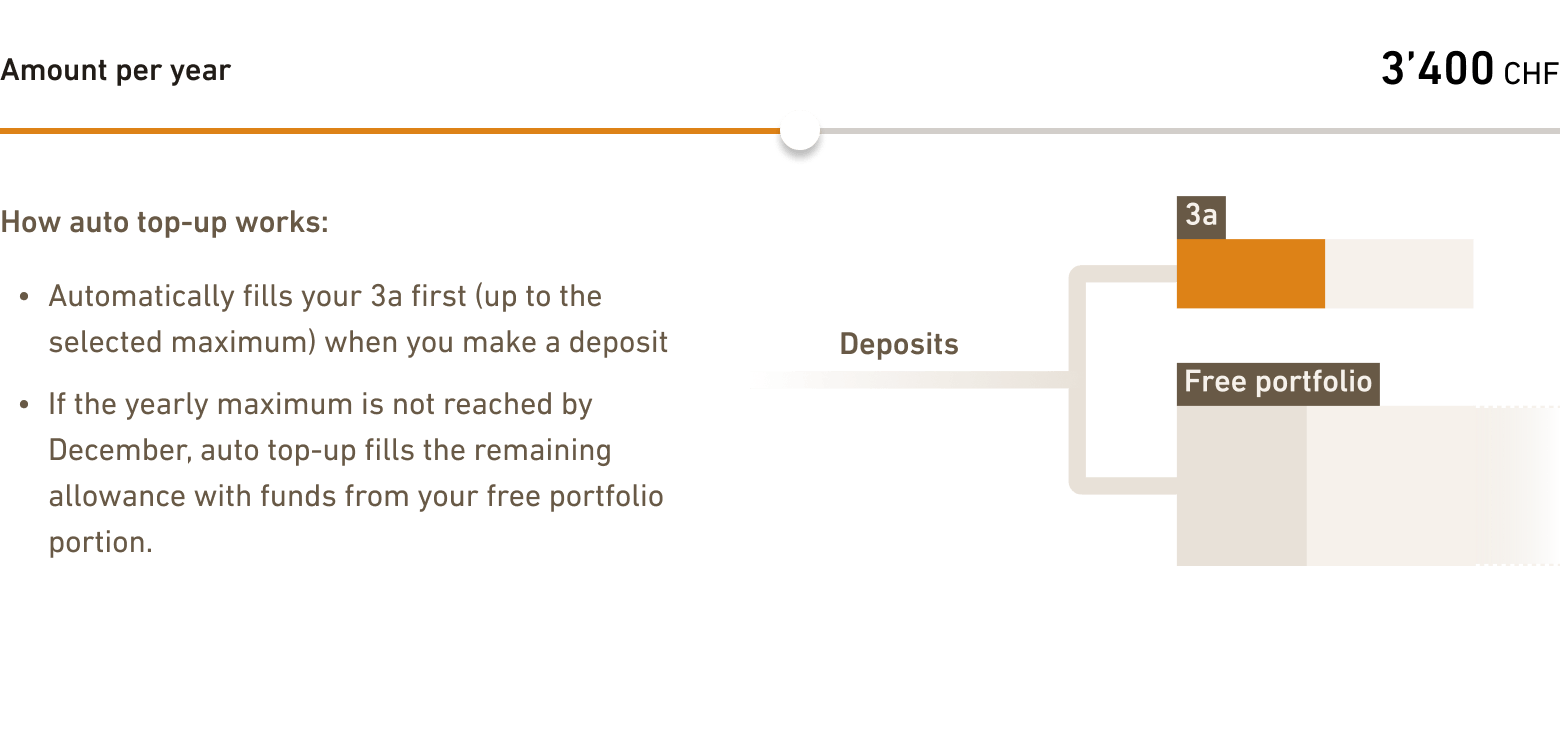

Automatic deposits (never miss out on tax benefits again)

Automatically several 3a accounts (for staggered, tax-efficient withdrawals)

Up to 99% equity exposure, choice of global or sustainable portfolio

Individual investment strategy

Transparent online reporting

Cost-efficient investment instruments (only ETF and index funds, no expensive actively managed funds)

Index funds exempt from withholding tax

Account-holding bank with state guarantee

Management fee

0.0%

Interest on cash

0.75%

This comparison refers to offers with at least 50% securities content and includes the following competitors: Finpension, Frankly, Viac, Descartes, Selma Finance and Inyova. Brand names are the property of their respective owners. Management costs, custody and administration fees of the pension schemes were considered; product costs (TER), stamp duties, trading spreads and currency exchange costs have been added where applicable.

Fees are subject to change.

Source: Websites of the respective providers and publication «Pillar 3a and Pillar 2 Digital Asset Management Services», Moneyland, 23.10.2024

Questions & Answers

We are happy to answer any question you may have. You can find the most frequently asked questions right here.

Your tax saving potential

Don't miss out on any Pillar 3a tax benefits!

Reading guide

The general 3a tax advantage amounts to around . The True Wealth automatic replenishment prevents forgotten deposit years and contributes about another . The automatic use of multiple 3a accounts and staggered payouts can reduce the payout tax rate, which brings an additional tax advantage of around .

* From the 2026 tax year onwards, it will be possible to catch up on missed purchases for previous years (from 2025). However, this option will be ignored by this tax calculator and missed payments will be treated as definitively missed.

The 3a calculator was last updated on 17.02.2023. All information is subject to change.

Ready to invest?

Open accountNot sure how to start? Open a test account and upgrade to a full account later.

Open test account